Apply for Atal Pension Yojana | Know About Scheme

3 min read

The Atal Pension Yojana or “Swavalamban Scheme” was introduced by the Government of India for the upliftment of the unorganized sector. Atal Pension Scheme was first introduced by Finance Minister Arun Jaitley and then It was launched by PM Narendra Modi On the 9th of May 2015 in Kolkata.

It is a pension scheme introduced by the government of India for its citizens involved in the unorganized sectors for earning their livelihood. In this scheme, one has to contribute a certain amount according to his or her choice until the age of 60. The scheme beneficiary can enjoy monthly remittance according to their contribution.

The Atal Pension Yojana is managed and monitored by the “Pension Fund Regulatory Authority of India“. This pension scheme was introduced to provide social security after a certain age.

Anyone who holds a citizenship of India can enroll themselves in this scheme and one must attain a minimum age of 18 to the maximum of 40 to benefit from this scheme. Any citizen can apply for this Atal Pension Scheme unless if any beneficiary is covered under any other statutory social security scheme and not eligible to receive any government its contribution.

Any employee in the public sector is cramped to be a beneficiary under the scheme as he or she may already be enrolled in other government schemes like the provident funds which is also a government-run scheme.

The recipient must have at least 20 years of contribution for availing the benefits of this scheme and the Applicant must hold an account in any National Bank or Post Office either of which should be linked to the Aadhar card. Citizens must have to produce there Aadhar Card which is a mandate for enrolling under this scheme and must have an Indian registered telecom mobile number for registration.

Guidelines to fill the form for the Atal Pension Scheme.

- The application process is not yet available in online mode. But the form can be downloaded from the online mode it can easily download from this site (https://www.india.gov.in/registration-form-atal-pension-yojana-apy)

- Forms are available in regional languages.

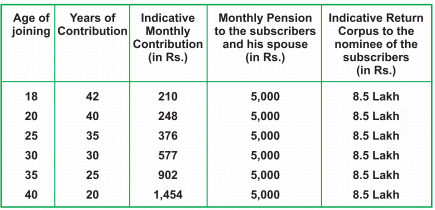

- The Atal Pension Scheme plan in segregated into the category according to individuals contribution.

- Contribution depends on the age and amount willing to receive after the maturity.

- The contribution can be done on a monthly, quarterly, yearly basis according to one choice.

- In case of default of payment under one has to bear a penalty varying on the amount of default amount.

If the default amount is not paid for a long time after 6 months the account gets frozen further if no action is taken by the beneficiary after 12 months the account gets deactivated and after 24 months the account is closed but the amount of contribution and the interest on it is returned to beholder excluding the government allowances.

Premature withdrawal is not allowed in this scheme except in the case of ultimate Pinnacle of life death or serious health issues. In case of death of the beneficiary spouse are directly eligible to claim the benefits of the pension scheme and in this spouse death, the nominee holds the right to assert the corpus amount. under this scheme citizens of India can enjoy tax benefit also under section 800CCD(1). although the Atal Pension Yojana enjoyed by the public is taxable.

Click For Know More Central Government Scheme